Let's Chat!

Tailoring the right solution for each business is what we are passionate about. Based on an initial chat with you, we'll be able to prepare a unique proposal for you and your business. We are based in Brisbane

Take a moment to connect with us using the form below, or call us directly on:

1300 255 337 (Mon. to Fri. 10 am - 4 pm):

The non-residents doing business in Australia who sell imported services and digital products to Australian consumers will be applicable.

When a foreign supplier of digital services has been established as an operating business in Australia for electronic distribution service, the operator will need to be registered for GST purposes. An example of this is iiNet/Netflix for the Netflix global company. Other examples include the larger businesses such as Apple, Google and Amazon.

Due to their size, GST collected would need to be reported on a monthly basis. However, the option to elect for limited registration for GST is also available, except this would mean that they would not be able to access input tax credits.

An aim in applying GST to digital supplies is to create level conditions for domestic businesses, that generally charge and remit GST on the digital products and services, will no longer be at a disadvantage in comparison to their overseas counterparts.

How to Claim GST from Overseas Suppliers and Service Providers

What Digital Products and Services

The key features include:

- Intangible supplies such as digital content, games, software, streaming or downloading movies, music, apps, games and e-books

- Will extend to the consultancy and professional services for software performed by offshore customers in Australia

- The GST will be at a rate of 10 per cent on the value of the supply provided.

- Selling goods through EBay or other online systems

- Services such as architectural or legal services

It is important to note that this only relates to supplies made to consumers. Business to business transactions will be exempt. So, this liability for GST will then be with the supplier or the operator of the business.

Other factors in establishing who should pay GST:

- Being able to define the operation of a business and its sources

- Excluding the digital supplies that relate to education and health services.

Additionally, currently goods under the value of $1000 from overseas suppliers across the internet imported by Australian consumers are not covered under the GST Act and not applicable for GST.

However, as from 1st July, 2018 overseas businesses will have an obligation to register and charge GST on imported goods under $1000.

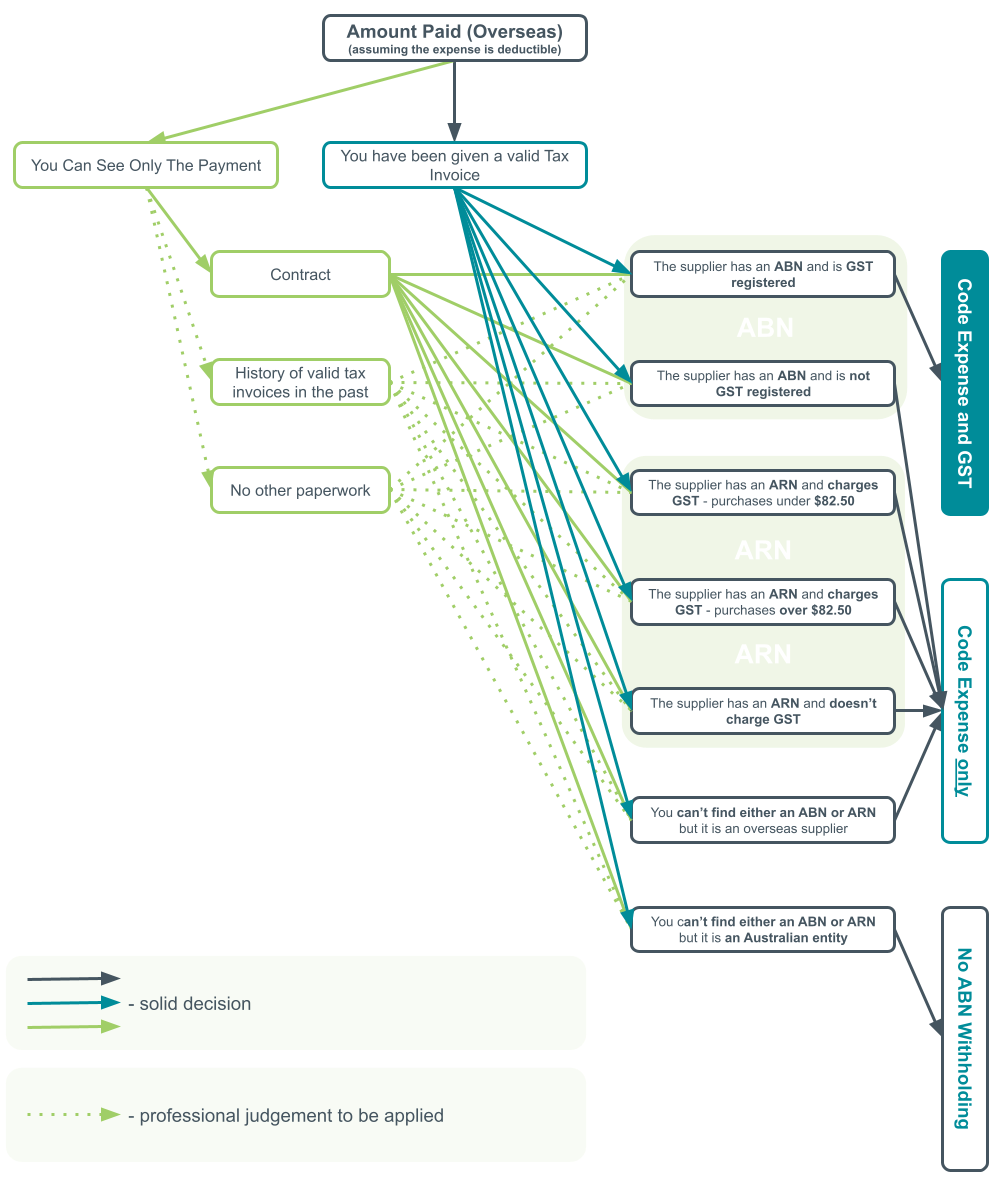

Bookkeeping for Digital Goods and Services

The main issue bookkeepers will come across in working with purchases of international digital products or services is ascertaining whether GST has been charged or not.

International businesses who register using the simplified GST system are not required to send invoices for products purchased online. Therefore, you may find that the digital goods transactions will be paid through a PayPal type platform which should provide reasonable receipts for processing. The payment online systems should be the best platform to be used for reporting online purchases.

We have created the list of overseas suppliers and subscriptions registered for GST. If you found anyone who should be in the list, please mention in in the comments.

Who should register for the Australian GST System?

The international businesses who sell digital products and services connected to Australia exceeding the value of AUD$75,000 of gross sales revenue must register and pay GST.

The best way to establish this is through the current year’s turnover or similarly, the projected year’s turnover is AUD$75,000 or higher. (For not-for-profits the value is AUD$150,000).

If you are an Australian business registered for GST, then GST will not apply to the services or digital products you import for use in your business. If you are not registered for GST, GST will apply to these purchases.

However, the supplier will not charge you GST if:

- Your Australian business number (ABN) has been provided, and

- You state that you are registered for GST.

ARN and Simplified GST registration

ARN stands for ATO registration. It is part of Simplified GST registration.

ARN is given to Australian non-residents for tax purposes who make sales to Australia of:

- online services and digital products to Australia.

- goods valued at A$1,000 or less (low value imported goods).

They cannot claim GST credits and must lodge GST returns and pay GST quarterly.

Subscribe by email and instantly get FREE Illustrated eBook. Adequate ‘positive’ cash flow is essential for the survival of any business, yet this is something that over 50% of small business owners struggle to manage.